Evidence based management, big data, and machine learning provides cutting edge insights into business model performance

Philadelphia – June 28, 2016 – A new research study to be published by the Wharton School of the University of Pennsylvania’s SEI Center for Advanced Studies in Management gives credence to the power of evidence based management, big data and machine learning when examining the performance of today’s digital platform and networked based business models. In a new book published today and co-authored by Yoram (Jerry) Wind, The Lauder Professor of Marketing and the Director of the SEI Center, called The Network Imperative (Harvard Business Review Press), revealed that “Network Orchestrators – organizations with digital platforms and virtual networks – are 2-4 times more valuable than traditional organizations. Further, they are more profitable, scale faster and have lower marginal costs (sometimes near zero)” said Wind.

Philadelphia – June 28, 2016 – A new research study to be published by the Wharton School of the University of Pennsylvania’s SEI Center for Advanced Studies in Management gives credence to the power of evidence based management, big data and machine learning when examining the performance of today’s digital platform and networked based business models. In a new book published today and co-authored by Yoram (Jerry) Wind, The Lauder Professor of Marketing and the Director of the SEI Center, called The Network Imperative (Harvard Business Review Press), revealed that “Network Orchestrators – organizations with digital platforms and virtual networks – are 2-4 times more valuable than traditional organizations. Further, they are more profitable, scale faster and have lower marginal costs (sometimes near zero)” said Wind.

The 3-year research project led by Wharton’s SEI Center Fellow Barry Libert and SEI Center Research Associate, Megan Beck, found that organizations focused on building and managing digital platforms with virtual networks (be they consumer, business or investor) significantly outperform all other types of business models on nearly every dimension. At the same time, the study showed that less than 2% of companies today operate the most valuable business.

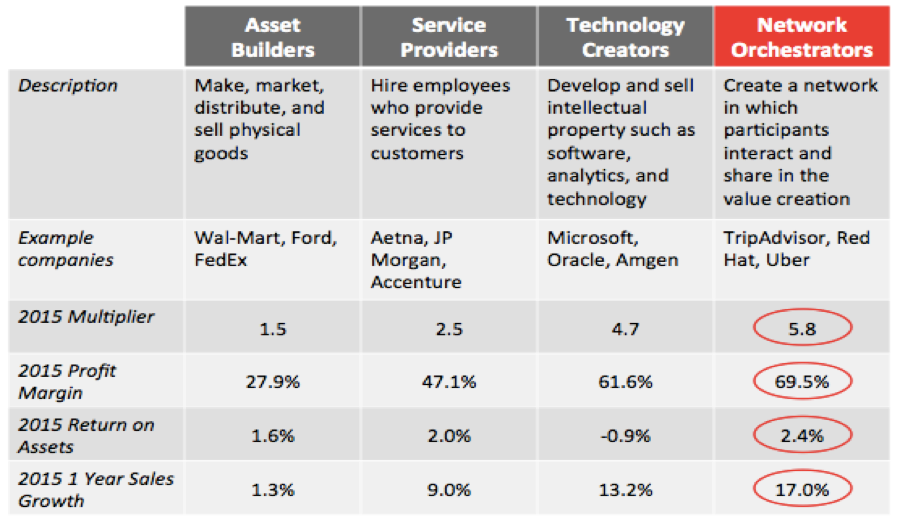

The study used machine language, big data, and evidence based management to analyze 1,500 companies and 4000 inputs. It found that there were 4 primary business models, which the researchers called:

- Asset builders – manufacturers, distributors, and retailers

- Service providers – consultants, bankers, educators, and lawyers

- Technology creators – biotech, healthtech and fintech

- Network orchestrators – social, business and financial

Further, it found that network based business models yield, on average, the highest return on invested capital, produce the largest profit margins, and generate the most revenue growth. As a result, their market value per dollar of revenue is also the highest. According to Mr. Libert: “Network Orchestrators, which leverage intangible assets, and real time interactions, apply to all organizations regardless of industry. Further, the performance differential (which we call the Multiplier Effect) was surprisingly large due to the new rules of strategy that are being ushered in based on network versus firm centric business models” (See below figure).

Figure 1: The 4 Business Models

Megan Beck said “After conducting this detailed research, we are finally able to quantify the value of platform and network based businesses. Our research supports our hypothesis that these new business models – which are based on two sided revenue models and customer co-creation – are more scalable than traditional organizational strategies that are based on one sided, supply driven competition founded in the industrial.”

Megan Beck, continued, ‘Organizations that leverage the ‘tangible and intangible assets’ of their networks (be they cars, houses, friends or insights) perform better financially than those organizations that don’t’.

Professor Wind elaborated on additional findings of the team. “We also examined the words that leaders use to define their strategy and what they value. This machine learning research confirms what my Center has been suggesting for the last 2 decades – Leader’s ‘mental models’ (e.g. their attitudes, behaviors and beliefs about value and organizational design) determine what they do and more specifically how they allocate their firm’s financial and human capital. This supports what many of us have long believed – mental models create business models and therefore organizational value. For example, leaders of Network Orchestrators regularly use words like platform, network, digital and mobile to describe their firms and investment strategies whereas ‘Asset Builder’ leaders talk about plant, property and equipment as their primary focus and investments”.

“Given the increasingly platform environment in which we all live and connect,” said Libert, “We can now use machine language, big data and evidence based management as emerging fields to advise all boards and leaders – be they for profit or not, large or small. We can show leaders that two sided revenue models that leverage demand side thinking, digital platforms, stakeholder interactions and co-creation will create, over time, better growth and profits.”

Beck summarized her team’s work as follows: “Given these findings, it is our intention to continue our research by expanding our database of companies as well as correlating business models with outcomes to help leaders modify their traditional supply-side mental models and strategies advocated by Michael Porter 30+ years ago. In addition, we intend to continue to use machine learning and big data to be able to visualize business models in real time to help leaders and investors make more informed decisions in order to invest their limited resources to avoid risk and enhance returns.”

About the Wharton School: Founded in 1881 as the first collegiate business school, the Wharton School of the University of Pennsylvania is recognized globally for intellectual leadership and ongoing innovation across every major discipline of business education. With a broad global community and one of the most published business school faculties, Wharton creates economic and social value around the world. The School has 5,000 undergraduate, MBA, executive MBA, and doctoral students; more than 9,000 participants in executive education programs annually and a powerful alumni network of 94,000 graduates.

About the SEI Center: The Wharton SEI Center for Advanced Studies in Management is led by Yoram (Jerry) Wind, and is the world’s first “think tank” for management education. The Wharton SEI Center ensures the relevance of management research and teaching to the evolving needs of business and society in the 21st century. More specifically, the SEI Center has a dedicated research project called the 21st Century Enterprise. The mission of The 21st Century Enterprise project is to examine the emergence of new digital, networked based, governance models and their impact on sources of risk and reward for governments, businesses and not-for-profit organizations. This initiative is led by Barry Libert and Megan Beck.

About The Network Imperative: How to Grow Survive and Grow in the Age of Digital Business Models, is co-authored by Barry Libert, Megan Beck, Jerry Wind. The book is published by Harvard Review Business Press.